seattle payroll tax calculator

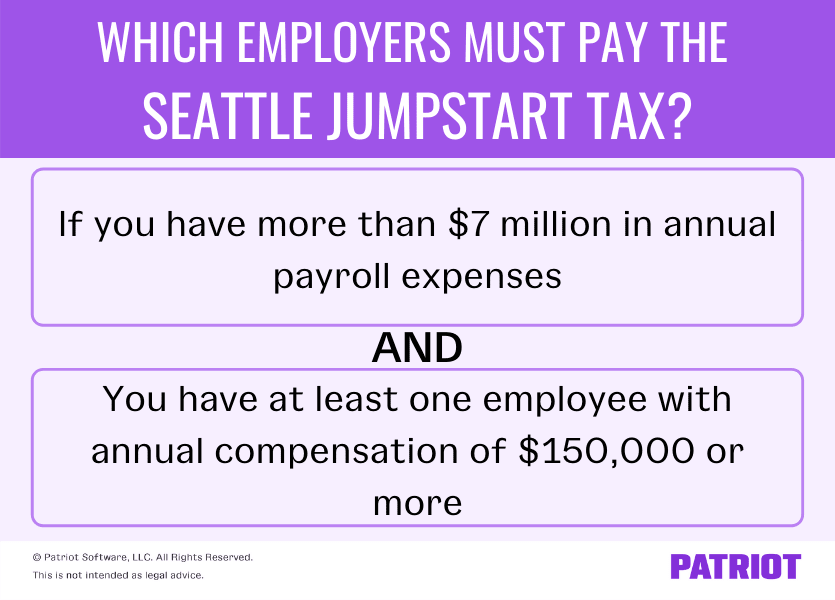

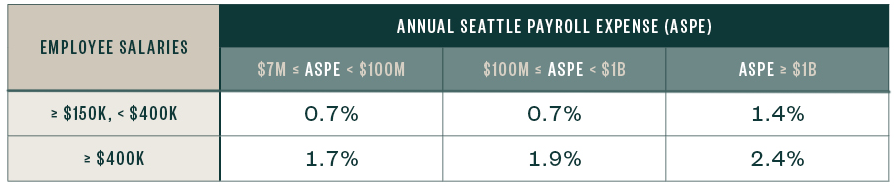

The Seattle payroll tax is measured by the payroll expense of the business times a rate that varies based on the businesss total Seattle payroll expenses and the compensation paid in Seattle to each employee whose annual compensation is 150000 or more. The tax colloquially known as the payroll tax targets companies that have 739 million or more in payroll expenses and Seattle employees who make at least 158282.

Seattle S Payroll Expense Tax On Salaries Of Top Earners Bader Martin

It is not a substitute for the advice of an accountant or other tax professional.

. The Washington Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Washington State Income Tax Rates and Thresholds in 2022. Another thing you can do is put more of your salary in accounts like a 401k HSA or FSA. For 2022 the wage base is 62500.

Use the paycheck calculator to figure out how much to put. The tax rate ranges between 7 and 24 and is based on both the annual compensation paid to each employee and the total Seattle payroll expense of the business. 2021 Social Security Payroll Tax Employee Portion Medicare Withholding 2021 Employee Portion To contact the Seattle Department of Revenue please call 360-902-9620.

The highest tax only applies to companies with 1 billion or more in payroll and only on employee earnings of 400000 or more. Get Started With ADP. Ad Process Payroll Faster Easier With ADP Payroll.

This calculator is intended for use by US. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Washington residents only. This Washington hourly paycheck calculator is perfect for those who are paid on an hourly basis.

The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time. Our payroll software is QuickBooks compatible and can export payroll data to. While the ordinance has not yet been signed by the mayor as of publication the tax.

Washington is one of several states without a personal income tax but that doesnt mean that the Evergreen State is a tax haven. Seattles Payroll Expense Tax will begin on January 1 2021 and continuing to December 31 2040 applying rates ranging from 07 of payroll expenses up to 24 for companies with the highest payroll expenses. After a few seconds you will be provided with a full breakdown of the tax you are paying.

First reporting for employers will begin on December 31 2023. Switch to Washington salary calculator. Switch to Washington hourly calculator.

Workers Compensation Tax is a bit more. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. As shown in the table above for businesses with annual Seattle payroll expense greater than 7 million either a 7 or 14 tax rate.

If you contribute more money to accounts like these your take-home pay will be less but you may still save on taxes. To use our Washington Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. The payroll tax also called JumpStart tax was passed by Seattle City Council in June 2020 and went into effect on January 1 2021.

9 Total Seattle payroll. Washington Salary Paycheck Calculator. Take a look at a.

It can also be used to help fill steps 3 and 4 of a W-4 form. Washington State Unemployment Insurance varies each year. Seattle collected more than.

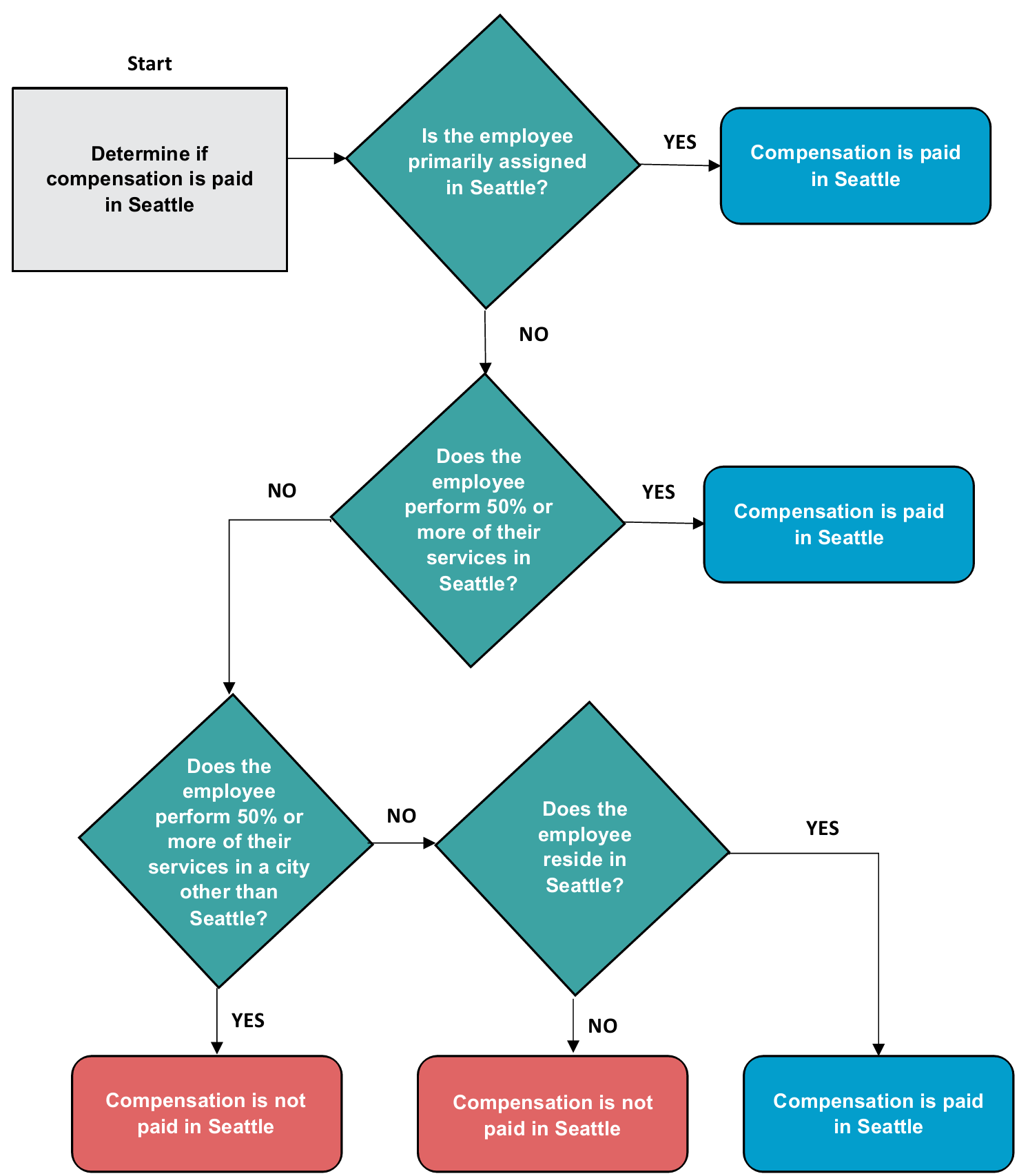

The Seattle Finance Administrative Services published a Directors Rule Template to clarify the language to provide examples for reporting and paying. Seattle businesses must choose the method theyll use to determine how to assign payroll tax liability to the city at the beginning of the year for the citys business tax targeting businesses. Calculate your Washington net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Washington paycheck calculator.

These changing rates do not include the social cost tax of 122. Rates also change on a yearly basis ranging from 03 to 60 in 2022. Discover ADP For Payroll Benefits Time Talent HR More.

While taxpayers in Washington dodge income taxes they pay some of the highest sales taxes in the country with a. The Seattle City Council passed a bill creating a new payroll tax on persons engaged in business in Seattle. Move forward to July 2020 and the Seattle City Council passes another form of payroll tax.

New employers use the average experience tax rate of 1 for 2022. The City of Seattle Washington will impose a new employer-only Payroll Expense Tax effective 1 January 2021The filing of this tax was optional until Q4 2021and Zenefits is supporting this tax starting Q4 2021The full amount due for 2021 must be paid by January 31 2022This tax applies to businesses operating in Seattle with some exceptions. The table below shows the applicable tax rates.

Details of the personal income tax rates used in the 2022 Washington State Calculator are published below the. Washington Hourly Paycheck Calculator. The payroll expense tax also known as JumpStart Seattle City Ordinance 126108 Council Bill119810.

The 2021 payroll tax rates range from 07 to 24 and are subject to change annually. Although the tax has been in effect for the past year the first payment of Seattles Payroll Tax is due January 31 2022. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Washington Paycheck Calculator Smartasset

Seattle S Payroll Expense Tax On Salaries Of Top Earners Bader Martin

Seattle S Payroll Expense Tax Upheld By Trial Court Time For Employers To Gear Up For Reporting Insights Davis Wright Tremaine

New Seattle Jumpstart Tax Overview Rates More

What Is The Tax Rate In Seattle Usa Quora

Capital Gains Tax Indonesia The Basics Of Accounting And Tax Reporting

The Seattle Payroll Expense Tax What You Need To Know Clark Nuber Ps

Gusto Help Center Washington Registration And Tax Info

Income Tax Filing Services Tax Advisors In Kent Wa Seattle Usa

Seattle Wa Payroll Services Abdiwali Mohamed Cpa Pllc

Kent Tax Service Income Tax Advisors In Kent Wa Seattle Usa

3 292 Payroll Tax Photos Free Royalty Free Stock Photos From Dreamstime

Seattle S Payroll Expense Tax Upheld By Trial Court Time For Employers To Gear Up For Reporting Insights Davis Wright Tremaine

Washington State How Much Tax Do We Usually Pay While Working In Seattle Quora

Seattle Payroll Expense Excise Tax Details

New Tax Law Take Home Pay Calculator For 75 000 Salary

Business License Tax Seattle Business And Occupation Tax B O Tax Akopyan Company Cpa Seattle Accounting Firm Taxes Payroll